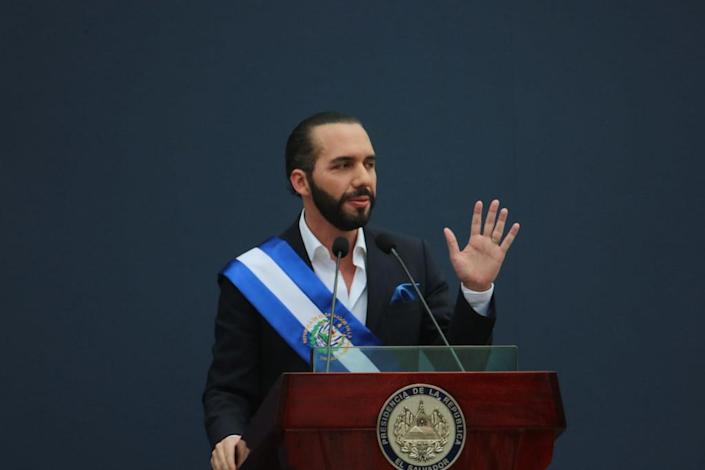

In its ratings action, Moody’s lowered El Salvador’s long-term, foreign-currency issuer and senior unsecured ratings to Caa1 from B3. Noting a “deterioration in the quality of policymaking,” the agency said that the Bitcoin law and other measures reflected “weakened governance in El Salvador, raising tensions with international partners – including the United States – and jeopardizing progress toward an agreement with the IMF (International Monetary Fund).”

The ratings action added that the combined factors could increase the risk to El Salvador’s ability “to access sufficient external financing ahead of bond redemptions,” starting in January 2023.

The Bitcoin law, which goes into effect Sept. 7, requires merchants to accept Bitcoin along with the U.S. dollar. The law passed by a supermajority in El Salvador’s legislature on June 9, with 62 members voting in favor of the bill, 19 opposing and three abstaining, but it has also faced stiff dissent with some opponents arguing it violates El Salvador’s constitution.