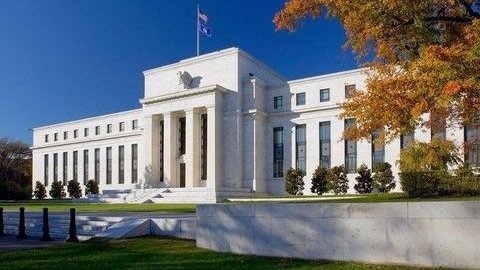

The Federal Reserve has switched on its new instant payment system, FedNow, with 35 banks and credit unions onboard.

The 35 early-adopting banks and credit unions are joined by the US Department of the Treasury’s Bureau of the Fiscal Service and 16 payment processing service providers.

“The Federal Reserve built the FedNow Service to help make everyday payments over the coming years faster and more convenient,” says Federal Reserve chair Jerome H. Powell. “Over time, as more banks choose to use this new tool, the benefits to individuals and businesses will include enabling a person to immediately receive a paycheck, or a company to instantly access funds when an invoice is paid.”

He says the Fed is committed to working with the more than 9,000 banks and credit unions across the country to support the widespread availability of instant payments for their customers over time.

As an interbank payment system, the FedNow Service operates alongside other longstanding Federal Reserve payment services such as Fedwire and FedACH.

The launch is coming at a cost. In June last year, the Fed decided to delay the implementation of the ISO 20022 payment messaging format by two years to 2025 in response to bank concerns that this process was hampering FedNow’s rollout.