Switching to the Satoshi standard and Lightning Network connectivity makes Bitcoin more tangible and easy to use. AAX has made the first move in the crypto space, already providing BTC to SAT

Hedera Solidity Smart Contracts Bringing Highest-Speed Programmability to Tokenization

Hedera Hashgraph, the most used, sustainable, enterprise-grade public network for the decentralized economy, today announced an upgrade to its Smart Contract Service, which will soon allow developers to harness the speed and scalability of the Hedera Token Service (HTS) for fungible and non-fungible tokens with the flexibility of fast, low-fee, and industry-standard Solidity smart contracts.

The upgrades will include integrating the Hyperledger Besu EVM and a unique virtual merkle data structure to more efficiently manage state changes on the Hedera network, as well as creating a new and highly performant database for state storage. These innovations enable new use cases that have been too slow and expensive to function well on existing smart-contract-based platforms.

“Smart-contract-driven applications today are powering an ecosystem of users, capital, and applications, driving trillions of dollars in economic activity. In Q2 2021 Ethereum settled $2.5 trillion in transactions, but this is just the tip of the iceberg in terms of the amount of commerce that can be pushed through Solidity-based contracts if they can be made orders of magnitude faster and more scalable,” said Atul Mahamuni, SVP of Products for Hedera. “With these enhancements, we are enabling the large and growing ecosystem of hundreds of thousands of Solidity and Vyper developers to make Solidity contracts extremely fast and highly scalable.”

Since its launch in February 2021, the Hedera Token Service (HTS) has seen broad adoption for use in applications leveraging both fungible and non-fungible tokens (NFT). HTS offers users the ability to issue and configure tokens on the Hedera platform, taking full advantage of Hedera Hashgraph’s native performance, security, stability, and governance with the ability to scale to thousands of transactions per second.

With the enhancements to Hedera’s Smart Contract service – which will be scalable to hundreds of transactions per second with finality in seconds and low, predictable fees – developers will be able to also enable programmability of those tokens, to enable DeFi and other applications, which require payments based on certain actions being taken or conditions being met. Smart contracts only have to be called as-needed, not during ordinary transfers, thereby taking advantage of the native speed of HTS, and offering the most flexible way to achieve programmability.

“At DOVU we are building proof-of-carbon, a trusted audit trail for the full verification, minting, and ongoing audit of carbon credits, our cDOV assets. We decided to leverage the Hedera network because it is unparalleled in cost and time to finality, and have the proven green credentials to boot,” said Matt Smithies, CTO of DOVU. “The new enhancements to Hedera’s Smart Contract service will ultimately enable DOVU to achieve our vision to evolve into a complete, non-custodial solution for our farmers and land managers to prove the ongoing storage of carbon. In other words, this has the potential to unlock the ability for DOVU to track decades worth of changes of carbon for a single project, whilst utilizing the security and native speed of Hedera Hashgraph, without relying on any layer 2 network.”

Indonesia’s Xendit becomes Southeast Asia’s latest Unicon

LiveDigital payments infrastructure provider Xendit has nabbed a $150 million Series C that elevates the company to a short list of Southeast Asia unicorns. Businesses from small kiosks (warungs) to SMBs and large players like Transferwise and Grab use Indonesian-based Xendit’s API-based technology to process payments, run marketplaces, disburse payroll, and detect fraud.

The firm, which says it is processing more than 65 million transactions with US$6.5 billion in payment value annually, intends to use use the new funding to scale its business, which mainly operates in Indonesia and the Philippines.

“It’s now clear that businesses need to have a digital presence,” says Moses Lo, co-founder and CEO, Xendit. “Xendit’s digital payments infrastructure enables the region’s new class of entrepreneurs to start and scale their payments faster and supercharges larger companies with modern, world-class financial services. What AWS has done for Compute, Xendit is doing for payments.”

The new financing comes just six months after the firm raised $64.6 million in a Series B led by Accel.

The latest round was led by Tiger Global Management with participation from existing investors Accel, Amasia, and Justin Kan’s Goat Capital.

Algorand Foundation Launches $300 Million USD Fund to Support DeFi Innovation

LiveThe Algorand Foundation, an organization dedicated to fulfilling the global promise of blockchain technology, by leveraging the Algorand protocol and open-source software, today announced the Viridis DeFi Program, a 150 million Algo (worth approximately $300 million USD today) fund to support DeFi innovation on the Algorand network. The fund will fuel the growth of decentralized exchanges, money markets, options markets, synthetic asset applications, and NFT platforms, all running on the best blockchain network for the future of finance.

“The Algorand Foundation is excited to launch this funding program to help accelerate the adoption of DeFi across the Algorand Ecosystem. Creating the right infrastructure, application ecosystem and liquidity will be key to ensuring that DeFi on Algorand is regarded as the world’s most energy-efficient, scalable and low-cost DeFi ecosystem” said Sean Lee, CEO of the Algorand Foundation.

Founded in 2017, Algorand was built from the ground up to handle the volume of transactions needed for DeFi, financial institutions, and governments to smoothly transition to the future of finance or FutureFi. The blockchain technology of choice for nearly 1,000 global organizations, Algorand enables the frictionless exchange of value and the simple creation of next-generation financial products and protocols.

50million ALGO, which has been re-allocated from the AlgoGrant fund, will exclusively support the development of DeFi infrastructure and applications ( DApps ). Within this, DeFi “SupaGrants” have been designed to support the creation of critical DeFi infrastructures such as cross-chain bridges and price oracles. The first $5M SupaGrant will be a call for proposals to build bi-directional bridges from Ethereum and other chains. Once ported to Algorand, DApps need access to market data to manage a variety of smart contract functions. The second $5M SupaGrant will seek proposals for the integration of oracle networks with associated price feeds. The balance of this fund will support further application development across this burgeoning DeFi ecosystem.

Since liquidity is a fundamental driver of DeFi and DApp adoption, the Algorand Foundation is assigning a fund of 100 million ALGO (worth approximately $200m USD today) to support and provide liquidity incentives to the Algorand DeFi ecosystem. In doing so, the Algorand Foundation is ensuring that quality DeFi projects will be able to access liquidity easily while also incentivising liquidity providers for fueling DeFi on Algorand. A number of projects, such as the first automated market maker DEX https://tinyman.org, have already engaged with the Foundation to ensure that they will have the appropriate liquidity support required at launch.

By supporting DeFi infrastructure, DApps and Liquidity with this dedicated fund, innovators and developers will be able to make an immediate impact on Algorand’s DeFi ecosystem. And they will be doing so on the most sustainable, carbon negative, high-performance blockchain in crypto today.

Crypto platform Bitso to work with El Salvador’s Chivo digital wallet

Fintech Bitso, a cryptocurrency platform, said on Tuesday it will be the core service provider for Chivo, the bitcoin digital wallet launched in El Salvador as it becomes the first country in the world to adopt bitcoin as legal tender.

Bitso said it will work with Silvergate Bank, a U.S. federally regulated and California state-chartered bank, to facilitate transactions in U.S. dollars.

“We are looking forward to working with El Salvador in an initiative that will transform payment structures and increase financial inclusion in the country,” said Santiago Alvarado, vice-president of Bitso for Business.

President Nayib Bukele, who pushed for the adoption of the cryptocurrency, has argued that using bitcoin will help Salvadorans save $400 million a year on commissions for remittances while giving access to financial services to those with no bank account.

Bitso said that its services accounted for the processing of more than $1.2 billion in remittances between the United States and Mexico in 2020 and that it would now apply its expertise to El Salvador, where some 70% of people lack adequate access to basic financial services.

Salvadorans last year sent home almost $6 billion from abroad, mostly from the United States. The sum is equivalent to some 23% of the country’s gross domestic product.

Bukele’s government has promised $30 of bitcoin for each user. Earlier on Tuesday, Salvadorans trying to download the Chivo digital wallet found it was unavailable on popular app stores.

PayPal To Acquire Japanese firm Paidy in a $2.7 bln deal

U.S. payments giant PayPal Holdings Inc (PYPL.O) said it would acquire Japanese buy now, pay later (BNPL) firm Paidy in a $2.7 billion largely cash deal, taking another step to claiming the top spot in an industry witnessing a pandemic-led boom.

The deal tracks rival Square Inc’s (SQ.N) agreement last month to buy Australian BNPL success story Afterpay Ltd (APT.AX) for $29 billion, which experts said was likely the beginning of a consolidation in the sector.

The BNPL business model has been hugely successful during the pandemic, fuelled by federal stimulus checks, and upended consumer credit markets.

These alternative credit firms make money by charging merchants a fee to offer small point-of-sale loans which shoppers repay in interest-free instalments, bypassing credit checks.

El Salvador buys $21 million of bitcoin as it becomes the first country to make it a legal currency

LiveEl Salvador bought roughly $20.9 million worth of bitcoin, one day before it formally adopts the world’s most popular cryptocurrency as legal tender.

In a series of tweets Monday, President Nayib Bukele revealed that the country had purchased a total of 400 bitcoin, the first step in a larger push to add the digital currency to its balance sheet.

The tweets were posted a few hours apart. Based on the bitcoin price at the time of the tweets, the amount of the digital coin purchased totalled roughly $20.9 million.

“Our brokers will be buying a lot more as the deadline approaches,” he wrote.

The price of bitcoin rose following the tweets and was trading at around $52,681.85 at 12:16 a.m. ET Tuesday.

Point raises $46.5 million to give millennials a rewards-based alternative to credit cards

Reward-based debit card startup Point has closed a $46.5 million Series B funding round led by Peter Thiel’s Valar Ventures. Point is bringing the high-end credit card experience to young millennials floundering in debt, offering a debit card and linked bank account that features a range of premium perk-based benefits.

Point Card provides cardholders unlimited cash-back by earning points on every purchase, alongside extensive travel protections and purchase insurance benefits.

Reward points are geared to the youth market, including monthly subscriptions like Netflix and Spotify, and rideshares and food delivery services such as Uber and DoorDash. The company claims to provide the average cardholder with $1,230 in value annually.

Opening a Point account currently costs $49 per year and comes with two free ATM withdrawals per month and no foreign transaction fees.

The latest funding round follows a $10.5 million Series A raise in March 2020, bringing Point’s total funding to $60 million.

Point CEO and Co-founder, Patrick Mrozowski, says: “We are so excited to announce our Series B funding round today to bring a superior debit experience to Gen Z and Millennials, who have been massively underserved by legacy banking institutions with clunky debit cards with no rewards, or credit cards that trap them into debt.”

He says the new financing will allow the company to grow its team, expand features, and build a more extensive product suite.

Leading Digital Bank Chooses Tezos to Expand DeFi Offerings

Live

EQIFI, a regulated and licensed decentralized finance platform, has announced new products supporting the Tezos blockchain ecosystem. EQIFI has chosen Tezos because it is a leading Proof of Stake network with time-tested on-chain governance, an active DeFi (decentralized finance) ecosystem, and a global community of builders and creators. This new product launch cements EQIFI as a leader in the DeFi space and as the world’s first seamless bridge to decentralized finance.

EQIFI will offer Tezos staking and borrowing services to its global customer base. EQIFI is powered by EQIBank, one of the world’s leading licensed and regulated digital banks. EQIFI operates under a community-focused, decentralized standard through its native EQX token. This allows community members to provide input on decisions such as listing and delisting assets and tokens, adjusting interest rates according to the market, and modifying collateral limits.

“A product offering with an industry leader such as Tezos signifies the bar EQIFI is setting in the DeFi space. Providing exposure to Tezos holders for staking and borrowing is just the next step in positioning EQIFI to become an industry leader.” – Jason Blick, Chairman of EQIFI

Tezos is one of the original Proof of Stake smart contract layer one blockchains. Since launching in 2017, it has successfully upgraded itself seven times, logged millions of transactions, and attracted a vibrant, global community. Developers are able to easily build powerful tools and products, while new users can explore NFTs, DeFi, DAOs, and more across hundreds of decentralized applications running on Tezos.

Tezos’ Proof of Stake design means it can operate in an energy-efficient manner, consuming over two-million times less energy than popular Proof of Work networks – this makes it an ideal platform for building blockchain applications that are energy-efficient and sustainable.

EQIBank offers competitive rates, 24/7 service, trusted security and an innovative, simple online global banking experience. EQIBank provides bank accounts, loans, custody, debit and credit cards, over the counter, and wealth management to EQIFI and all its qualified clients.

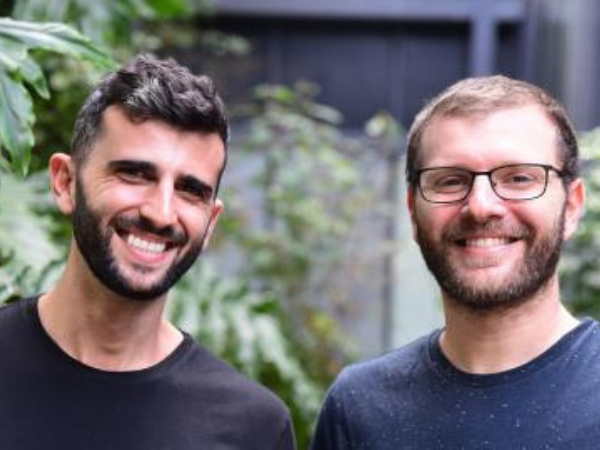

Balance raises $25m for B2B digital checkout platform

LiveBalance, a digital checkout platform for B2B businesses, has raised $25 million in Series A funding led by Ribbit Capital with participation from Stripe.Avid Ventures, Lightspeed Ventures, Y Combinator Continuity Fund, SciFi VC and UpWest and a host of early employees and executives from Square, Plaid, Coinbase, Stripe, and PayPal joined the round.

Balance officially launched its self-serve digital checkout platform earlier this year, vowing to transform the online payments experience for B2B companies, bringing an Amazon-like experience.

The platform lets any merchant, marketplace or SaaS company that sells goods and services online and offline offer their buyers a wide array of payment methods and terms, and get paid instantly.

Balance says users get a payment experience that is as convenient as consumer checkout, automatic collection, reconciliation and settlement, instant, automated financing, and APIs for developers.

The startup is already partnering with e-commerce giants like BigCommerce, as well as Magento, leading B2B e-commerce agencies, and soon to include Salesforce.

Bar Geron, CEO, Balance, says: “Global B2B trade being done mostly offline is resulting in high cost of living and economic inefficiencies, worldwide. We are at the very early innings of a massive shift from offline to online, across industries.

“Our goal is to facilitate this transition with an amazing transaction experience for businesses and suppliers, making it a no-brainer for every B2B business to start selling online.”

Stock Brokerage firm Alpaca raises $50m and moves into crypto trading

LiveAlpaca, a stock brokerage platform that offers APIs for fintech apps to connect and trade in US stocks, has raised $50 million and laid out its plan to launch cryptocurrency trading.Tribe Capital led the Series B funding round, with participation from Horizons Ventures, Eldridge, Positive Sum, Portage Ventures, Spark Capital, and Social Leverage.

Launched in 2018, Alpaca has seen a 1500% year to date growth in brokerage accounts and expanding partnerships across Europe, Southeast Asia, Africa, North and Latin Americas.

Yoshi Yokokawa, CEO, Alpaca, says: “By the end of the year, we’re going to see close to 100 global fintech apps built with our APIs go live with their stock trading platforms.

“We’re unlocking the ability to invest in U.S. companies in places around the world that have never had this opportunity and through fintech partners that share our vision of democratizing investing.”

The firm is now set to launch a cryptocurrency product for both its retail consumers and B2B partners. Customers will soon be able to buy, sell, hold, and trade cryptocurrencies via Alpaca’s developer-first APIs.

Alpaca has also teamed up with Plaid to allow broker API partners to simplify the account funding experience for their customers.