Switching to the Satoshi standard and Lightning Network connectivity makes Bitcoin more tangible and easy to use. AAX has made the first move in the crypto space, already providing BTC to SAT

Why El Salvador Bets Big On Bitcoin

El Salvador will become the first nation in the world to formally adopt the digital coin as a currency.

How can El Salvador benefit from bitcoin? What are the potential risks? And how on the other hand will the move change what does that mean for bitcoin?

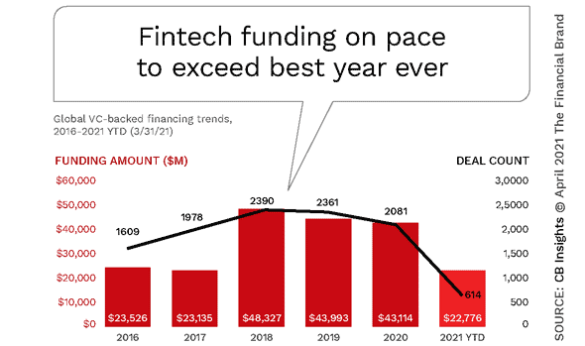

Global Fintech Funding Records New High Quarter1 of 2021

LiveSource Fintech Weekly: The quarterly “State of Fintech Q1’21 Report”, published by CB Insights provides a recap of global funding trends, sector-by-sector analysis, as well as a recap of major happenings in the fintech space during the quarter. This report also serves as a guide to what segments of banking are being prioritized by the marketplace.

In the first quarter of 2021, fintech firms worldwide raised $22.8 billion in investments through 614 deals. – more than doubling the amount raised in the fourth quarter of 2020 – and representing the largest venture capital-backed fintech funding quarter ever, according to research released by CB Insights. The first quarter 2021 numbers even surpassed the the previous funding record from Q2’18 that included Ant Group’s $14 billion funding round.

Much of the growth in the first quarter can be attributed to the 57 mega-rounds of $100 million+ that occurred in the first quarter. This was the most mega-rounds ever, accounting for 69% of total funding in the quarter. This made the average deal size for Q1’21 almost double what was seen in Q4’20 – from $19.3 million to $37 million.

North America led the fintech funding race (264 deals/$12.8B), followed by Europe (151 deals/$5B) and Asia (147 deals/$3.7B). Combined, these three regions accounted for over 90% of the total fintech funding for the quarter. While Australia (11 deals/$193M) and South America (20 deals/$999M) both saw modest increases in deals, Africa saw a 22% drop in deals during Q1’21 (21deals/$45M). Europe saw funding growth almost triple quarter-over-quarter, attributed to mega-rounds which accounted for 68% of the continent’s total funding for the quarter.

Not All Sectors Participated Evenly in Fintech Funding Growth

When the funding is broken down by sectors, there were some that saw significant growth in Q1’21, while others saw only modest gains. The largest levels of funding were in the payments, digital banking, digital lending and wealth management sectors