Switching to the Satoshi standard and Lightning Network connectivity makes Bitcoin more tangible and easy to use. AAX has made the first move in the crypto space, already providing BTC to SAT

Bybit partners with Mastercard to offer crypto payments debit card

LiveBybit announced the launch of Bybit Card, a debit card powered by the Mastercard network, issued by Moorwand. This card will allow users to off-ramp crypto into the fiat world to make purchases or take out cash from ATMs with ease.

Bybit Card will enable users to skip intermediaries and other off-ramp providers and debit their crypto balances directly to pay for goods and services. It will be available for clients in eligible countries in Europe and the UK who have completed the necessary KYC and AML procedures.

Initially, Bybit Card will be available for a selection of blue-chip cryptocurrencies, namely, BTC, ETH, USDT, USDC, and XRP. Payment requests will automatically convert balances in these digital assets into EUR or GBP, depending on the client’s country of residence.

Bybit launched its free virtual card earlier this week allowing for online purchases, with a physical card planned to launch in April. The plastic cards will be mailed directly to clients and allow them access to ATM withdrawals as well as spending at merchants worldwide with spending limits aggregated across currencies held in their Bybit account.

“Bybit users will be able to access and manage their funds faster, more securely, and more conveniently,” said Ben Zhou, co-founder and CEO of Bybit. “By launching Bybit Card, we are creating a full 360-degree journey for our users, offering next level reliability, products, and opportunities. We are confident that these innovative payment solutions will improve people’s lives and are a step towards a brighter future for crypto and finance.”

Christian Rau, Senior Vice President, Fintech and Crypto, Mastercard Europe added “Mastercard enables customers, merchants and businesses to move digital value — traditional or crypto — however they want, with the confidence that they are doing so safely and securely. With launches like this, we’re excited to continue to innovate in payments by making digital assets more accessible across the ecosystem.”

Crypto Exchange MaskEX Launches Virtual Card and Appoints Ben Caselin as Vice President

LiveMaskEX, a rapidly expanding third-generation crypto exchange, headquartered in Dubai, has announced the launch of its crypto-backed Virtual Card, enabling users to spend their crypto as fiat in more than 176 countries with over 50 million merchants worldwide. This new feature is now available to all ID-verified MaskEX users.

MaskEX has also announced that Ben Caselin, former Head of Research and Strategy at Hong Kong-based crypto exchange AAX, has joined MaskEX in the role of Vice President. Drawing on nearly 4 years at AAX, Mr. Caselin has played an important role in driving the mainstream adoption of bitcoin and digital assets through the platform, especially in emerging markets. At MaskEX, Mr. Caselin will oversee all global and localized marketing, communications and business development initiatives.

“We are excited to offer our users the ability to spend their crypto wherever and whenever they want with the launch of the MaskEX Virtual Card,” said Eric Yang, CEO of MaskEX. “Our vision is to make crypto more accessible and find ways to integrate crypto more with people’s everyday lives.”

“We are also delighted to be joined by Ben Caselin, not only because we believe he can play a vital role in our global expansion efforts, but also because of the terrible situation he has witnessed up close at AAX, following the collapse of FTX in late 2022. As we have observed, he puts users before business, and in reaching out to Ben, we have specifically asked him to be uncompromising and closely scrutinize our operations.”

“As a third-generation crypto exchange we are one of only 18 centralized exchanges globally that provide Proof-of-Reserves,” said Mr. Yang, “and with Abu Dhabi’s Sovereign Wealth Fund, under Sheikh Hamad Rakadh Salem Hamad Alameri, as a major stakeholder, we know we are in a very good place to compete with the world’s biggest trading platforms.”

On joining MaskEX, Mr. Caselin stated that “while the industry is still suffering from contagion and a severe lack of investor confidence, we cannot afford to give up now.”

“At this stage in the development of this nascent industry, properly managed centralized exchanges can still play an important role in raising awareness around digital assets, providing a point of contact for regulators, cooperating with the existing banking sector and payment providers to accelerate integration, and, of course, in driving the mainstream uptake of bitcoin and digital assets everywhere.”

FinaMaze Appoints Industry Leader Grant Niven as New Board Advisor

FinaMaze has announced the appointment of Grant Niven to its Advisory Board, effective February 2023.

The ADGM-based innovative digital wealth management firm made the announcement in pursuant to progress in its growth and sustainability, as it continues to provide cutting-edge financial investment services within the Fintech space.

Originally from Scotland, UK, Grant has worked in several executive roles over the last 24 years spanning the technology, consulting and financial services industry, in both Europe and the Middle East. Prior to recently founding Mingzulu, a strategy & venture funding advisory, focused on the Financial Sector, (including Fintechs), Grant held a role as Head of Group Digital at Banque Saudi Fransi, (BSF), HQ in Riyadh, KSA; where he was accountable for defining and executing the Bank-wide digital vision and strategic initiatives across the organisation.

Among other significant roles, he previously held a partner position within EY Middle East & North Africa (MENA) where he led the Technology Advisory practice for the financial services sector across the region.

Grant is a regular public speaker and prominent voice at leading events across the region on the topics of digital banking and ventures, Fintech, Open Finance and adoption of disruptive technologies in the financial services sector.

With his rich experience, he is clearly a great addition and good fit for the FinaMaze Advisory Board; as the firm has carved a niche for itself since 2020 as an innovative digital wealth management establishment working to push beyond the limits of what has traditionally been known to be ‘possible’ in Personalised Asset Management.

Speaking on his latest role at FinaMaze, Grant said: “Delighted to support the next chapter of growth for FinaMaze leadership, shareholders and end customers. Mehdi Fichtali (CEO) and the wider board’s vision and ambition to transform wealth management has really caught my attention and impressed myself and fellow Mingzulu team with what has been achieved to date. We are really looking forward to supporting the next chapter of innovation in the Wealth & Asset Management sector and honored to work in partnership with Mehdi and his team to accelerate their strategy & growth plans. The industry is ripe for disruption and FinaMaze has the smarts, people with deep wealth advisory expertise, combined with leading technologies such as Artificial Intelligence (AI) to make not only a huge regional impact – but internationally on a global stage ”.

Mehdi Fichtali is the CEO of FinaMaze, and this is what he has to say about Grant’s appointment to the Advisory Board:

“We are absolutely thrilled to welcome Grant to our Advisory Board! With his extensive experience spanning over two decades at the forefront of the intersection between technology and banking, Grant brings an unparalleled wealth of knowledge to our team. As an ex-partner at one of the top four consulting firms and a former Head of Digital at a major Saudi banking group, Grant is not only a strategic thinker but also an execution guru in the digital banking space. We are confident that his expertise will prove invaluable in guiding us through the ever-evolving landscape of the financial industry, particularly in the Wealth and Asset Management space for banks in the region. We can’t wait to see the amazing things we’ll achieve together with Grant on board!”

In his market projection for 2023 made during the last episode of “Light in the Markets Maze” – a webinar hosted by FinaMaze; Mehdi mentioned it likely being an eventful year for investing looking at the emerging trends that favour personalised asset management rather than an overall passive investment.

FinaMaze has over the years introduced and actively managed both long and short personalised Smartfolios that have offered various protection options.

It is expected that the firm will make a number of key appointments in line with its vision, and these would be announced within the course of the year. To know more about FinaMaze, download the app or kindly contact +971 58 538 8757 or email support@finamaze.com with your enquiries.

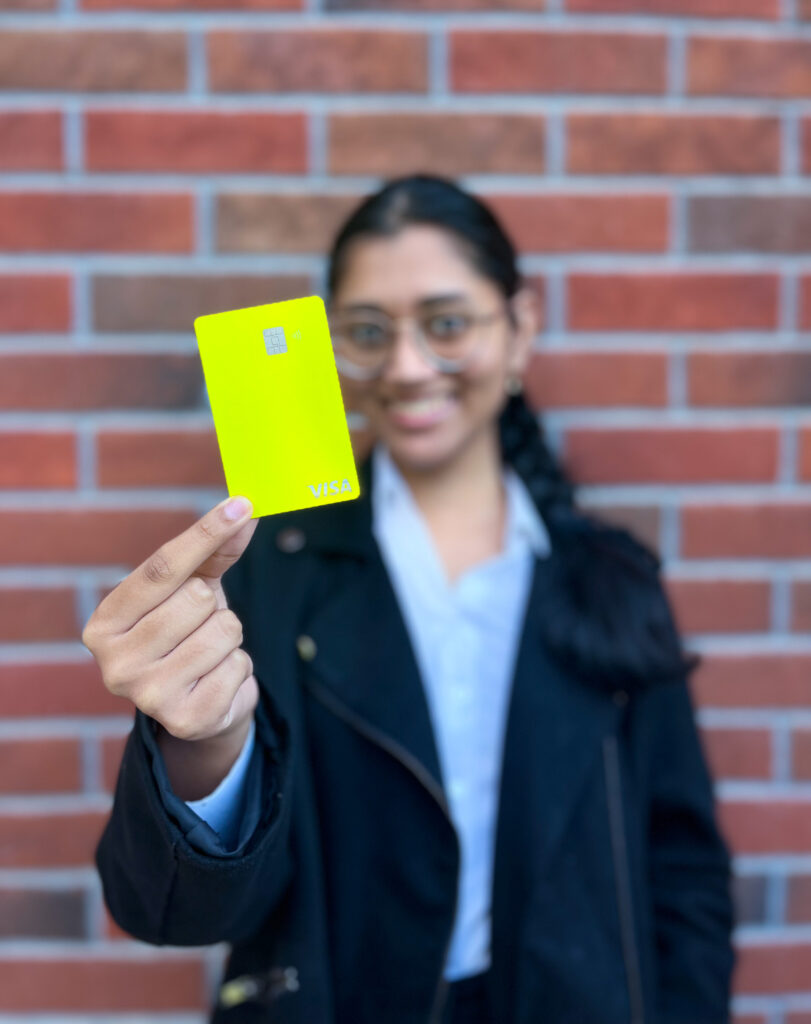

Savii Goes Live in UAE and Announces Launch of Numberless Visa Cards for Youth

LiveSavii, the financial platform designed for teens and young adults, today announced their official product launch in the UAE. The Savii payments app and Visa prepaid card allows teenagers and young adults to make payments independently and relieve parents of the anxiety of giving them premature access to their own credit card.

Jane Harvey, Co-founder and CEO of Savii commented “If you are a parent, giving your teens some financial responsibility early on is a smart move. They’ll get to flex their money management skills, like budgeting and saving, learn the value of a dirham and begin to appreciate the consequences of overspending. And yes, they may make small mistakes along the way, but that’s all part of the journey, right? By the time they’re adults, they’ll be more confident with their finances which will boost their overall confidence and independence.”

With the newly launched Savii app, parents can now send money to their teens instantly through the app making the distribution of monthly allowances a lot easier. As an important bonus, Savii allows parents to view all the transactions made by their children giving them further peace of mind. The app is accompanied by the Savii card, a numberless Visa payment instrument which means all card details are stored securely in the Savii app. The numberless card feature eliminates the risk of personal card information getting disclosed if the card gets lost or stolen, and the card can be paused or blocked at the click of a button in the app.

Nichola Collinson, Co-founder of Savii added “We have designed a product with the worries and concerns of the parents in mind, and we managed to bring to the market a product that will bring financial independence to the teenagers while parents can be at peace that the systems in place are designed to protect the identity and financial security of their kids. We partnered with the best in the market at Visa to create a truly secure card.”

Alex McCrea, Visa’s Vice President, Head of Strategic Partnerships and Ventures for Central Europe, Middle East and Africa, added “At Visa, we understand the importance of empowering the next generation with the tools they need to independently manage their finances. Our partnership with Savii will provide young adults in the UAE with the freedom and flexibility to make purchases, build their credit history, and take control of their financial future. We are delighted to partner with Savii as part of our pledge to enabling financial inclusion for everyone, everywhere, and are confident that this partnership will make a positive impact on the lives of young people in the region.“

Savii’s product roll-out in the UAE is the first of a series of regional launches set to be announced in the coming months.

Hong Kongbased livi bank moves into wealth management

ivi bank, Hong Kong’s leading lifestyle-driven virtual bank, is continuing its development with the pilot launch of its wealth management service, which follows closely on livi’s launch of its first offering to Hong Kong’s SME business community.

livi is now able to distribute funds managed by third-party fund managers to its customers as part of its wealth management offering as a registered institution, following approval for registration to carry out Type 1 Regulated Activity (Dealing in Securities) under the Securities and Futures Ordinance. livi will begin its pilot launch of this service shortly, with its full public launch targeted later in the first half of the year.

With a vision of helping customers seamlessly manage their wealth, livi bank is committed to leveraging its technological expertise to provide a simple, convenient and secure digital platform for accessing wealth management solutions.

David Sun, livi bank Chief Executive Officer, said “We are excited to further expand our financial footprint with innovative offerings with many industry firsts already introduced, including livi PayLater, our NFT collections, and our market-first fully-automated business account opening.

“Our wealth management solutions will address the underserved needs in the market with simple and transparent digital solutions for customers to grow their wealth. Wealth management will be an important business driver for livi and we will continue expanding our digital wealth capabilities to empower our customers to achieve their financial goals,” David Sun added.

Paymentology appoints Nadia Benaissa as global head of marketing

LivePaymentology announces the appointment of Nadia Benaissa as Global Head of Marketing, and member of its leadership team.

Nadia is a seasoned marketing expert with a passion for fintech, bringing with her more than 20 years’ experience across five continents, in payments, banking and fintech. As the global Head of Marketing at Paymentology, Nadia will spearhead the company’s continued expansion across the UK, Europe, Middle East and Africa, Asia-Pacific and Latin America.

Abe Smith, Chief Growth Officer at Paymentology commented on the appointment: “With two decades of experience in leading cross-functional global marketing teams in the fintech industry, we are incredibly excited to welcome a leader of Nadia’s calibre to the team. Her proven track record of delivering results through strategic marketing communications, and passion for the industry, make her the perfect candidate to support us in achieving our growth ambitions.”

Nadia Benaissa, Global Head of Marketing at Paymentology added: “Throughout my career I have chosen to work with dynamic fintech organisations that are leading from the front in the global progress towards the digitisation of financial services. That’s why I am delighted to join the Paymentology team. With customer centricity at the core, together with its clients and partners, Paymentology is providing access to financial services and placing cards into the hands of millions of people across the globe, via localised, data-driven, next generation payment solutions. I look forward to building on the existing successes of the organisation with an enhanced global marketing programme.”

An active member of the fintech ecosystem, Nadia co-chairs the payments committee at the MENA Fintech Association, is a member of the financial inclusion working group at Payments Association UK, and an active member of the Financial Alliance for Women. Nadia is also a mentor to burgeoning fintechs and startups at Startupbootcamp, the world’s largest network of multi-corporate backed accelerators.

Prior to joining Paymentology, Nadia was the Marketing Director at BPC, supporting its growth journey, along with the creation of new fintechs and before that worked at Germany’s Digital Fintech and neobank Fidor as the Global Chief Marketing Officer developing its international growth. She has also worked with CR2, an Irish-headquartered omnichannel banking player, leading the company’s communications and marketing strategy across emerging markets.

At the start of her career, Nadia was the youngest employee at AEMS Paris, a joint venture between Euronext and Atos, where she helped set up the corporate communications and marketing department from the ground up. The company developed ‘exchange as a service’, with trading, clearing and settlement solutions dedicated to stock exchanges worldwide and was further acquired by the New York Stock Exchange (NYSE Technologies).

Hong Kong plugs its crypto credentials while rival Singapore is backtracking

LiveHONG KONG – Hong Kong will be an excellent place for crypto, fintech, and other start-ups to set up shop in the new year, the city’s financial secretary said on Monday, looking past the current upheaval in the industry.

Mr. Paul Chan, speaking at a Web3 forum in the Cyberport business park, said Hong Kong remains committed to becoming a regional crypto hub – an ambition expressed at the end of October, just before Sam Bankman-Fried’s FTX exchange had its industry-altering meltdown – and will work to attract new businesses from all over the world.

Hong Kong is keen to plug its crypto credentials at a time when rival Singapore is backtracking, spooked by the fallout from the derailment of FTX.

Following the city’s policy statement, several leading tech firms and start-ups are now considering a move of their headquarters or an expansion to Hong Kong, Mr. Chan said, without disclosing their names.

“As certain crypto exchanges collapsed one after another, Hong Kong became a quality standing point for digital asset corporates,” said Mr. Chan, who has been Hong Kong’s financial secretary since 2017. He added that the city has a robust regulatory framework that “matches international norms and standards” while prohibiting free riders.

Hong Kong is preparing to issue more licenses for digital asset trading firms. The city is also planning a consultation on crypto platforms – exploring the potential for retail participation in the industry – the details will be published soon, said Mr. Joseph Chan, Under Secretary for Financial Services and the Treasury, at the same event.

Change of Leadership at Securrency: Ex-State Street Nadine Chakar Joins as CEO

LiveSecurrency, a leading developer of institutional-grade, blockchain-based financial and regulatory technology, today announced that Nadine Chakar will join the company and assume the role of Chief Executive Officer effective January 9th, 2023.

Ms. Chakar’s leadership will combine her deep financial services, technology, and market experience with Securrency’s groundbreaking technology to deploy market-leading solutions on a global scale. She has been recognized as one of the most powerful women in finance and is a vocal champion for using technology to revolutionize financial services. Ms. Chakar brings over 30 years of experience in global wealth and asset management to Securrency. Most recently, she served as Executive Vice President and Head of State Street Digital, where she built and led the team that is helping State Street, institutional investors, and regulators successfully navigate the bank’s transition into a modern digital economy. Ms. Chakar also led State Street Global Markets, where she oversaw its trading, product, and operations platform, helping to drive successful client solutions. Prior to State Street, she served as global head of operations for Manulife’s Global Wealth and Asset Management Division and led the Global Asset Servicing teams for BNY Mellon.

In addition to her leadership at State Street Digital, Ms. Chakar has served as a member of the Board of Directors of Securrency since 2021. Her appointment as the CEO of Securrency highlights the growing importance of compliance aware tokenization, interoperability, and institutional DeFi to the future of global finance.

Ms. Chakar’s appointment will allow Dan Doney, Securrency’s founder, who has served as the company’s CEO and lead architect since its inception, to focus on innovation, technology delivery, and commercialization by continuing to serve as the Chief Technology Officer of Securrency. Mr. Doney is recognized as one of the preeminent thought leaders in the blockchain and decentralized finance space. This focus will accelerate the growth of Securrency’s blockchain-enabled financial services infrastructure market share.

Nadine Chakar, incoming CEO of Securrency said: “The financial services industry is at a critical tipping point as it tokenizes regulated real-world assets and automates legacy financial processes using the power of blockchain technology. The Securrency team has done a remarkable job of developing the most robust technology on the market. As the new CEO, my priority is to accelerate the commercialization of what is in essence the digital asset intelligence and interoperability foundation for major financial institutions and the global ecosystem. Dan Doney is a true visionary and innovator in the industry, and I look forward to working closely with him and the team to create the global digital assets marketplaces of the future.”

Dan Doney, Co-founder, and Chief Technology Officer of Securrency, said: “Nadine is an exceptional leader and Securrency has been fortunate to leverage her extensive financial industry expertise as a board member and now as incoming CEO. She knows capital market operations inside and out. Nadine shares my passion for innovation, and we are united in our determination to make financial markets more accessible and efficient. She has a razor-sharp view of where reform is needed and how our technology can help. I am excited to work with Nadine as we focus on evolving our solution to bridge traditional and decentralized finance.”

Jonathan Steinberg, CEO of WisdomTree, said: “The future of finance relies on regulation-forward and compliance-driven digital development and Nadine has long been a driver of this evolution. Working with Nadine as a client and industry leader, I have witnessed not only her tremendous expertise in the integration of RegTech and digital assets, but her steadfast belief that Securrency’s technology will pave the way for institutional DeFi. I congratulate Nadine, Dan, and the entire Securrency team on this bold move for the company.”

Bankman-Fried left in the lurch as former executives plead guilty

LiveTwo high-level associates of FTX founder Sam Bankman-Fried have pleaded guilty to fraud charges relating to the spectacular implosion of the cryptocurrency exchange.

Carolyn Ellison, the former CEO of trading firm Alameda Research, and FTX co-founder and chief technology officer Gary Wang are cooperating with a wide-ranging investigation into criminal misdemeanors at bankrupt crypto exchange FTX.

According to the SEC, between 2019 and 2022, Ellison, at the direction of Bankman-Fried, furthered the scheme by manipulating the price of FTT, an FTX-issued exchange crypto security token, by purchasing large quantities on the open market to prop up its price.

In doing so, Bankman-Fried and Ellison caused the valuation of Alameda’s FTT holdings to be inflated, which in turn caused the value of collateral on Alameda’s balance sheet to be overstated, and misled investors about FTX’s risk exposure.

In addition, from at least May 2019 until November 2022, Bankman-Fried is said to have raised billions of dollars from investors by falsely touting FTX as a safe crypto asset trading platform with sophisticated risk mitigation measures to protect customer assets and by telling investors that Alameda was just another customer with no special privileges; meanwhile, Bankman-Fried and Wang improperly diverted FTX customer assets to Alameda.

The SEC also alleges that Ellison and Wang were active participants in the scheme to deceive FTX’s investors and engaged in conduct that was critical to its success. The complaint alleges that Wang created FTX’s software code that allowed Alameda to divert FTX customer funds, and Ellison used misappropriated FTX customer funds for Alameda’s trading activity.

“As alleged, Mr. Bankman-Fried, Ms. Ellison, and Mr. Wang were active participants in a scheme to conceal material information from FTX investors, including through the efforts of Mr. Bankman-Fried and Ms. Ellison to artificially prop up the value of FTT, which served as collateral for undisclosed loans that Alameda took out from FTX pursuant to its undisclosed, and virtually unlimited, line of credit,” says Sanjay Wadhwa, deputy director of the SEC’s Division of Enforcement. “By surreptitiously siphoning FTX’s customer funds onto the books of Alameda, defendants hid the very real risks that FTX’s investors and customers faced.”

The European Central Bank will finalize the overall design of a digital euro in the second half 2023

LiveThe European Central Bank says it will finalise the overall design of a digital euro in the second half of next year as it publishes its second progress report on the project.

The report details the second set of design and distribution options that were recently endorsed by the ECB’s Governing Council and describes:

- the role of intermediaries, responsible for the onboarding of end-users, anti-money laundering checks, and consumer-facing services, such as payment initiation solutions;

- the settlement model, which defines who will settle online or offline transactions;

- the way in which funding and defunding will take place to allow users to convert cash and money from a bank account into digital euro;

- the distribution model. A digital euro scheme is envisaged since it is best suited to guaranteeing that all euro area citizens can pay and be paid in digital euro.

The central bank says it will assess a further number of design and distribution options before presenting a full report to the Governing Council later next year.

The ECB says the Governing Council will review the outcome of the investigation phase in autumn 2023 and decide whether to proceed to a realization phase.

Should the project get the green light, EU citizens are unlikely to get their hands on a digital euro until 2026 at the earliest.