Switching to the Satoshi standard and Lightning Network connectivity makes Bitcoin more tangible and easy to use. AAX has made the first move in the crypto space, already providing BTC to SAT

Bitcoin-Banning Measure Seen Too Close to Call in Monday’s EU Parliament Vote

LiveCoindesk: A proposed rule that could effectively amount to a ban on the leading cryptocurrency bitcoin will be voted on by European Union (EU) parliamentarians Monday with the outcome very much undecided.

The parliament’s economic and monetary affairs committee is set to vote on a draft of the proposed Markets in Crypto Assets (MiCA) framework, the EU’s sweeping legislative package for governing digital assets.

The draft contains a late addition that looks to limit the use of cryptocurrencies powered by an energy-intensive computing process known as proof-of-work. Although the vote is still a close call, a small majority of committee members may vote against the measure, according to people familiar with the matter.

CoinDesk reported that the provision in question requires all crypto assets to be subject to the EU’s “minimum environmental sustainability standards with respect to their consensus mechanism used for validating transactions, before being issued, offered or admitted to trading in the Union.”

For cryptocurrencies like bitcoin and ether, that are already being traded in the EU, the rule proposes a phase-out plan to shift their consensus mechanism from proof-of-work to other methods that use less energy, like proof-of-stake.

Although there are plans to move ethereum to a proof-of-stake consensus mechanism, it’s unclear whether the same option is available for bitcoin.

The provision was met with swift backlash from the crypto community worldwide.

“Extremely high stakes vote in the EU. That such a proposal made it this far is extraordinarily concerning and unlikely to stand up to practical reality,” said Jeremy Allaire, founder of Circle Pay, on Twitter.

A number of EU parliamentarians have been pushing to ban proof-of-work cryptocurrencies over energy concerns, even if the energy in question were to be renewable. They fear that renewable energy could be channeled into proof-of-work computing rather than the national grid destined for public use.

Credit Libanais partners with Codebase Technologies and VISA to empower the unbanked population

LiveCredit Libanais has partnered with VISA, the world leader in digital payments, and Codebase Technologies to develop a frictionless, omni-channel onboarding experience for customers looking to acquire virtual prepaid cards. This initiative comes at a time when over 6 million Lebanese are struggling from utilizing their debit and credit cards for purchases made abroad and online.

Credit Libanais, worked closely with the Lebanese Central Bank to get the approval on the first digital prepaid eKYC by a Lebanese bank, paving the way to offer the unbanked population a fully digital channel via a mobile application to instantly apply for a virtual prepaid card allowing people across Lebanon a quick and digital solution for international and online payments.

Built using Codebase Technologies, award winning Digibanc™ Suite, the solution will feature frictionless eKYC, omni-channel onboarding experiences, and empower Credit Libanais with rapid customer acquisition and customers with unique digital experiences. The Digibanc™ Suites modular and flexible architecture will support the necessary enterprise application interactivity requirements to ensure frictionless communication between various Credit Libanais systems: the bank’s card management system, AML, Email and SMS gateways, in order to validate the information filled by the user.

Mrs. Randa Bdeir, Deputy General Manager and Head of Electronic Payment at Credit Libanais said: We partnered with Codebase and VISA and came up with this innovative product that offers any Lebanese citizen the ability to apply for a virtual card through a mobile application with full eKYC process, thus reducing the need to visit the bank’s branches and go through the long physical application process”. This solution will drive financial inclusion further and grant the unbanked population with equal opportunities to access useful and affordable financial products and services that meet their needs and leads to a stronger and more sustainable economic growth and development and will offer any user the ability to use their card abroad with no restrictions.

Tamer Al Mauge, Codebase Technologies Managing Director MENA, commented “Lebanon is going through an unprecedented crisis that is massively impacting people’s lives. We’re proud to be working with strong partners, Credit Libanais, VISA and the Lebanese Central Bank to facilitate a first to market product for the Lebanese people. In line Codebase Technologies vision of utilizing technology for a greater purpose, we can’t think of a better way to leverage our expertise and solutions to empower the people of Lebanon with a new way to access and use much needed financial services.”

Mario Makary, Visa’s Country Manager in Levant stated “At the heart of our strategy lies access. The concept of ‘access’ for all, regardless of geography, social status, or financial education, that is a vital facet of who we are and what we do at Visa today. By accelerating digital-first experiences, we’re enabling the movement of money for everyone, everywhere. Our experience and resources joining forces with Codebase Technologies and Credit Libanais to help bring this service to the Lebanese customers is a milestone and we’re excited for the opportunities this will bring for the Lebanese market during these circumstances”.

State Street to enter digital custody business with Copper.co

LiveState Street, one of the world’s largest custodians, is to enter the digital asset safekeeping business using technology from London startup Copper.co.The Wall Street giant says it intends to launch an institutional-grade digital custody offering where clients can store and settle their digital assets within a secure environment operated by State Street.

Copper.co provides a gateway into the crypto asset space for institutional investors by offering custody, trading, and settlement across 450 crypto-assets and more than 40 exchanges.

“As institutional investors’ interest in digital assets continues to grow, we are building the financial infrastructure needed to support our clients’ allocations to this new asset class,” says Nadine Chakar, head of State Street Digital. “State Street Digital’s mission continues to focus on putting the right tools in place so we can provide clients with solutions to support their traditional, as well as digital assets needs.”

State Street began embracing the shift to decentralised finance in June last year with the creation of a new division specifically to engage with digital assets, including cryptocurrencies.

FTX chooses Stripe for payments and ID verification

LiveCrypto giant FTX and its US subsidiary have chosen Stripe to build an onboarding and identity verification flow for users joining the exchange, and to power payments for people adding funds to their accounts.Stripe will now power users who want to purchase cryptocurrencies with debit cards and ACH transactions directly from their bank.

In addition, FTX is using Stripe Radar to tackle fraud risk. Radar uses machine learning models and signals including customer details and billing information to distinguish fraudsters from legitimate customers.

Finally, the crypto exchange has chosen Stripe Identity to build an onboarding and identity verification flow designed to make it easier for new crypto investors to prove they are who they say they are.

Says FTX US President Brett Harrison: “We’re seeing greatly increased speed of KYC processing, higher rates of automated approvals, and a smoother UX for our customers.”

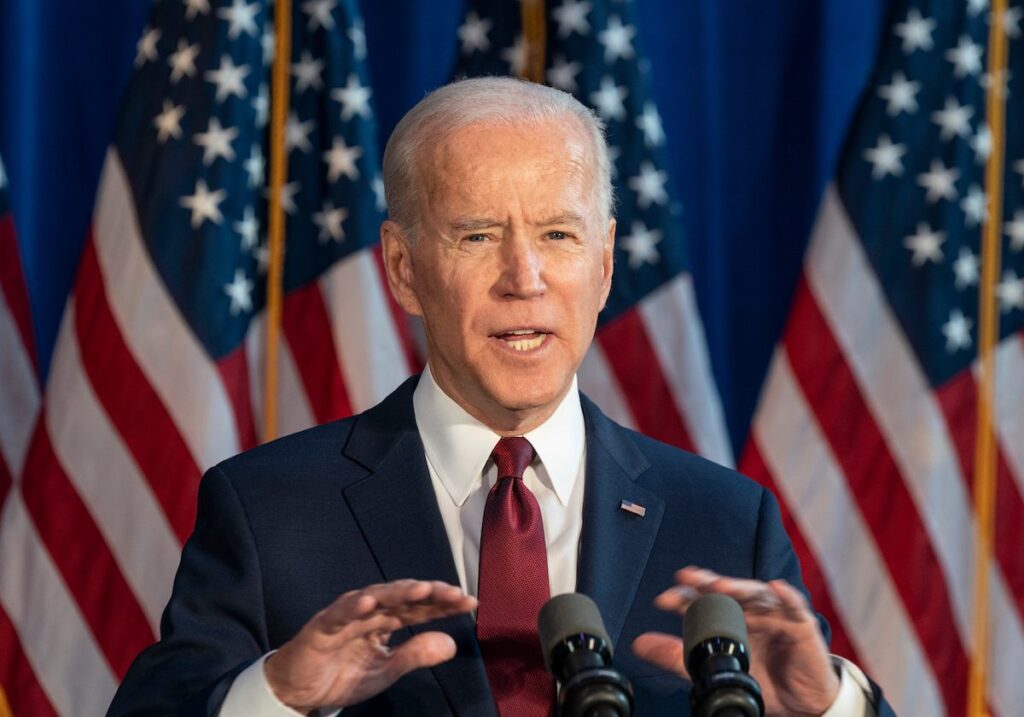

Biden’s Executive Order: Crypto Industry Sentiment is Hopeful but Cautious

LivePresident Joe Biden on Wednesday signed an executive order on government oversight of cryptocurrency that urges the Federal Reserve to explore whether the central bank should jump in and create its own digital currency.

The Biden administration views the explosive popularity of cryptocurrency as an opportunity to examine the risks and benefits of digital assets, said a senior administration official who previewed the order Tuesday on the condition of anonymity, terms set by the White House.

Under the executive order, Biden also has directed the Treasury Department and other federal agencies to study the impact of cryptocurrency on financial stability and national security.

The leaders shaping the crypto industry in the US received the news with caution and hope.

Jackson Mueller, Director of Policy, Government Relations at Securrency:

“Today’s Executive Order issued by the Biden Administration demonstrates that digital assets are here to stay and, as such, the Administration is now fully invested in developing an appropriate government-wide approach to the responsible development of digital assets. However, there are a few concerns raised by this Executive Order. First, is the administration unintentionally duplicating existing or ongoing work from a variety of agencies that could lead to disparate views between the Administration and independent financial regulatory authorities? Second, is the Administration setting up a clash with Congress, particularly as it relates to activating the DOJ to determine if legislative changes are necessary to launch a CBDC? Several lawmakers and Federal Reserve officials seem to think so, but the Administration could view this differently. Third, in seeking to address systemic risks from digital assets, which include stablecoins, the required Treasury-led FSOC report could provide further ammunition for the FSOC to jump ahead of Congress in setting the regulatory framework for stablecoins, which would mark a deviation from the recommendations contained in the PWG Stablecoin report and recent testimony from Under Secretary for Domestic Finance Nellie Liang.”

Tara Frater, Principal and Owner at FT Legal:

The order is, in effect, a salvo by the US declaring their intent to undertake a comprehensive investigatory analysis of the opportunities and challenges of digital assets and, in a coordinated manner, address regulatory overlap and, very likely, reduce any scope for regulatory arbitrage.

But the declaration is a validation of sorts of the significance of digital assets in our understanding of and trading in economic value; a recognition that we are most definitely in a new era; and more importantly that despite their reservations the US wishes to maintain thought leadership on policy issues.

Adrian Brink, founder of Anoma:

“The most immediately helpful actions would be for the administration to first, draft a straightforward and streamlined regulatory framework. Second, they should establish a digital USD that can be transferred between all chains in a permissionless fashion. In other words, a digital version of the USD issued by the U.S. Federal Reserve should be usable across chains (for example on Ethereum).

Governments should also support research into distributed systems and privacy. Distributed systems (or, blockchains) increase the resilience of their country’s financial infrastructure. By decentralizing the financial system, countries can achieve much higher fault tolerance and make themselves harder to attack by adversaries.

Additionally, governments should support technologies that safeguard privacy. These technologies protect individuals from foreign hostile actors and data hungry multinational corporations. The alternative is that anyone with a computer and internet could run a global financial surveillance program similar to the NSA and surveil U.S. citizens.

In summary, governments should invest in distributed systems and technologies that safeguard privacy to build more resilient systems, and provide asymmetric advantages in national defense.”

Sam Bankman-Fried – Founder FTX:

“We applaud the Biden administration for recognising the growing importance of the digital-asset space and believe today’s executive order is a significant step forward in building a strong regulated environment in the US. Innovation will always need to be coupled with safeguards and protections.”

Brad Garlinghouse, CEO Ripple Labs:

“Like many of you, I thought the Biden Admin’s EO would acknowledge crypto, but not detail specifics on next steps for regulation. However, I was pleasantly surprised & inspired by the EO acknowledging the *need* for evolution and alignment of the government’s approach to crypto.”

Jeremy Allaire, co-founder and CEO of Circle:

“For those of us in the crypto community, IMHO this E.O. should be viewed as the single biggest opportunity to engage with policymakers on the issues that matter. The proverbial doors of policymakers are WIDE OPEN, this is now a NATIONAL conversation in the U.S.”

Dubai adopts first virtual asset law

LiveThe emirate of Dubai has adopted its first law governing virtual assets and established a regulator to oversee the sector, its ruler Sheikh Mohammed Bin Rashid said on Wednesday.

The United Arab Emirates, a federation of seven emirates and the region’s financial capital, has been pushing to develop virtual asset regulation to attract new forms of business as regional economic competition heats up.

Virtual assets generally encompass products including cryptocurrencies and NFTs, but the announcement did not specify which assets would come under the new law.

Biden signs order on cryptocurrency as its use explodes

LivePresident Joe Biden on Wednesday signed an executive order on government oversight of cryptocurrency that urges the Federal Reserve to explore whether the central bank should jump in and create its own digital currency.

The Biden administration views the explosive popularity of cryptocurrency as an opportunity to examine the risks and benefits of digital assets, said a senior administration official who previewed the order Tuesday on the condition of anonymity, terms set by the White House.

Under the executive order, Biden also has directed the Treasury Department and other federal agencies to study the impact of cryptocurrency on financial stability and national security.

Brian Deese and Jake Sullivan, Biden’s top economic and national security advisers, respectively, said the order establishes the first comprehensive federal digital assets strategy for the United States.

Binance Launches Payments Technology Company, Bifinity

LiveBinance, the world’s leading blockchain ecosystem and cryptocurrency infrastructure provider, has today announced the launch of Bifinity as its official fiat-to-crypto payments provider.

Powered by Binance, Bifinity is a payments technology company that connects businesses, merchants and millions of users to the world of crypto and blockchain. Merchants can use Bifinity’s intuitive APIs to get their business crypto-ready and start accepting crypto payments. At the same time, consumers will have access to more user-friendly buy-sell crypto services and entry points.

“As the crypto and the Web3 economy continue to grow, we see greater demand to build improved fiat-to-crypto on-ramps to bridge the gap between the traditional finance industry and the decentralized and centralized crypto economy. At Binance, the vision is to increase the freedom of money globally. With the launch of Bifinity, we aim to accelerate mass crypto adoption,” said Helen Hai, President of Bifinity

Bifinity supports:

- Over 50 cryptocurrencies globally

- All major payment methods, including VISA, Mastercard and more

- Buy to sell crypto service for consumers

- Simple, intuitive and seamless API integration for merchants

- Low cost payment process fees for merchants

- Top-tier KYC onboarding process

Bifinity will also partner with leading crypto wallet providers and blockchain platforms, including Safepal and Ziliqa, to offer fiat on and off ramp solutions for their user base.

Building Web 3.0 with Payment Leaders

Cryptocurrencies will eventually power the economy for Web 3.0, the internet’s latest iteration. As part of efforts to build the Web 3.0 economy, Bifinity is partnering with Paysafe, a leading specialized payments platform; and Checkout.com, a leading global payments processor, to expand crypto access globally and allow more users to buy and sell crypto.

“We expect global e-commerce to continue outpacing the growth of traditional commerce—especially with the adoption of cryptocurrencies and NFTs,” said Max Rothman, VP of Crypto at Checkout.com. “Our payment rails already power the world’s leading crypto exchanges, representing almost 80% of the global trading volume. And that’s why our foundational partnership with Bifinity and the Binance platform is so important. Together we are lowering the barrier to entry for merchants to accept and make their first cryptocurrency transactions, enabling them to seize the great web3 opportunity that lies ahead.”

Through these partnerships, Bifinity will upgrade its on-ramp payment processing infrastructure This includes future plans to integrate enhanced fraud detection and payment transacting. Additionally, Paysafe will provide Bifinity with a deep regulatory know-how of fiat-to-crypto payments and an embedded finance solution that acts as a white label digital wallet. The embedded finance solution has already strengthened Bifinity’s on and off ramp capabilities and reactivated their SEPA bank transfers and Faster Payments.

Philip McHugh, CEO of Paysafe, said: “We have been very impressed by Binance’s commitment to grow as an evolving and maturing business and have witnessed first-hand their incredibly strong and positive customer engagement as they focus on delivering a payments service that consumers want. We’re very proud to partner with them, and we’ve already got off to a strong start with the successful delivery of a white label Bifinity wallet solution and we’re now working on some further exciting opportunities together. For us, this partnership is a great example of how we help our customers overcome payments pain points and grow.”

Future Plans

Bifnity will work in tandem with Paysafe to expand into Latin America, where it has a market-leading real time payments service. In the UK and Europe, Bifinity will integrate Paysafe’s card processing service over the next couple of months. On the NFT front, Bifinity will soon launch NFT checkouts, which allow users to buy NFTs across different platforms by linking their DEX wallets.

Joe Biden To Sign Executive Order on Crypto This Week

LivePresident Joe Biden is reportedly preparing to sign an executive order on cryptocurrency policy this week, according to a report by Reuters on Monday, which cited a person familiar with the matter.

The order, which may seek to appoint an individual with regulatory authority to oversee the crypto market, could come as early as Wednesday, per the report.

Jurisdiction of digital asset market oversight continues to burn in the minds of regulators eager to close the gap on what they perceive as trading activity occurring outside their remit.

Last month, Commodity Futures Trading Commission (CFTC) chair Rostin Behnam told a Senate committee hearing his agency wanted to be charged with regulating the crypto spot market.

During that hearing, Benham was asked whether a lead agency for regulating crypto should be established and said that his agency, along with the Securities and Exchange Commission, should share the responsibility.

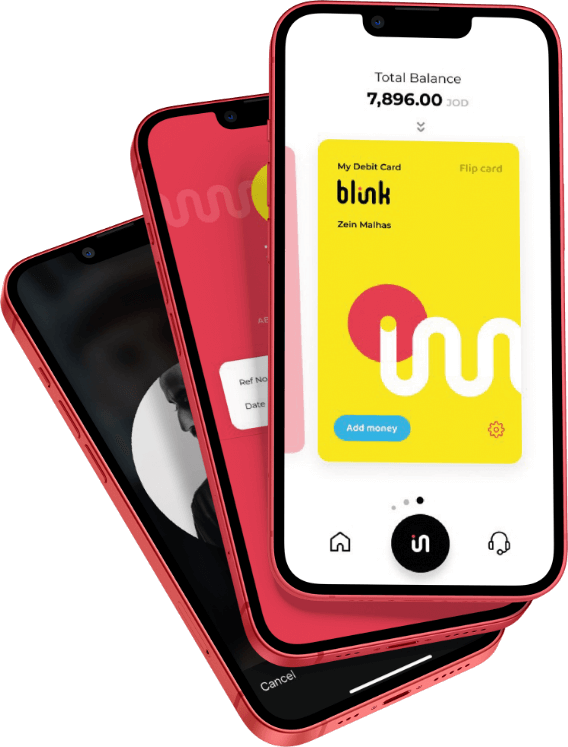

Capital Bank of Jordan takes live Blink neobank built with Codebase Technologies platform

LiveIn March 2021, Capital Bank of Jordan partnered with Codebase Technologies to build Blink, the first digital-only neobank in Jordan. The project officially commenced in late 2021 and in February 2022, Blink went live for Jordanian customers.

Blink was born out of a simple belief: money is meant to be easy; it’s meant to work for people, and not the other way around. Jordanians can open a Blink account directly from their smartphone with their Jordanian ID, in just 15 minutes, gaining access to an instantly issued virtual debit card and account. A physical card will be delivered directly to their chosen address. In addition, users can manage their accounts, send and receive money, view their transaction history and withdraw money from domestic and international ATMs.

Blink also offers its users instant credit cards which are issued within 3 minutes of an application and do not require a salary transfer by the customer. Blink neobank also offers its customers the highest credit card grace period in Jordan, allowing up to 60 days for settlement.

A robust product and service roadmap has been put in place that will offer Blink users new experiences and services as the neobank evolves and grows. The mobile-based neobank addresses the needs of the Jordanian market where mobile penetration stands over 90% of the total population as of 2020.

Built using Codebase Technologies’ award-winning DigibancTM platform, Blink incorporates an innovative UI system based almost exclusively on swiping – similar to how millennials and Gen Zers interact with social media – the first of its kind for a neobank. Together, Capital Bank of Jordan and Codebase Technologies developed Blink’s proposition, user journeys, launch strategy, and overall user experience. Blink’s enhanced agility and efficiency will foster the growth of Capital Bank of Jordan and counter security threats, high operation costs, and lack of transparency, which are key factors in digital banking from a customer and banks standpoint.

Codebase Technologies was able to configure its modular and highly flexible DigibancTM platform to allow Capital Bank of Jordan the flexibility and freedom to create a bank offering as per their exact requirements; one that is ready for new product and service innovations in the coming months and years. Using DigibancTM flexible and scalability nature Codebase Technologies was able to help Blink go live in just six months from project start.

Blink’s newly appointed CEO, Zein Malhas, points out “Blink will disrupt traditional banking by addressing the existing gaps from both banks and customers’ perspectives. We’re grateful to Codebase Technologies for being a committed partner and helping us in our journey of building a neobank. The chemistry between both teams was fantastic and we’re happy the team helped us bring our vision to life so quickly and to such a high standard. We look forward to further growth in the product and expansion to new markets in the future.”

Tamer Al Mauge, Managing Director – MENA of Codebase Technologies, added “The launch of Blink was a huge milestone for Codebase Technologies in Jordan and for the market. Building and launching the first neobank in Jordan is no small feat and we’re happy to have worked on this with Capital Bank of Jordan. The collaborative effort on this project was really inspiring and we look forward to continuing our work with Capital Bank of Jordan and their amazing team.”